In this article, we ask how the UK media spend landscape might look as we move through 2025 and into 2026.

We use publicly available AA WARC adspend data as a reliable source for baseline spend levels, and we use our own modelling to identify and extend underlying trends to forecast 2026 spends by channel.

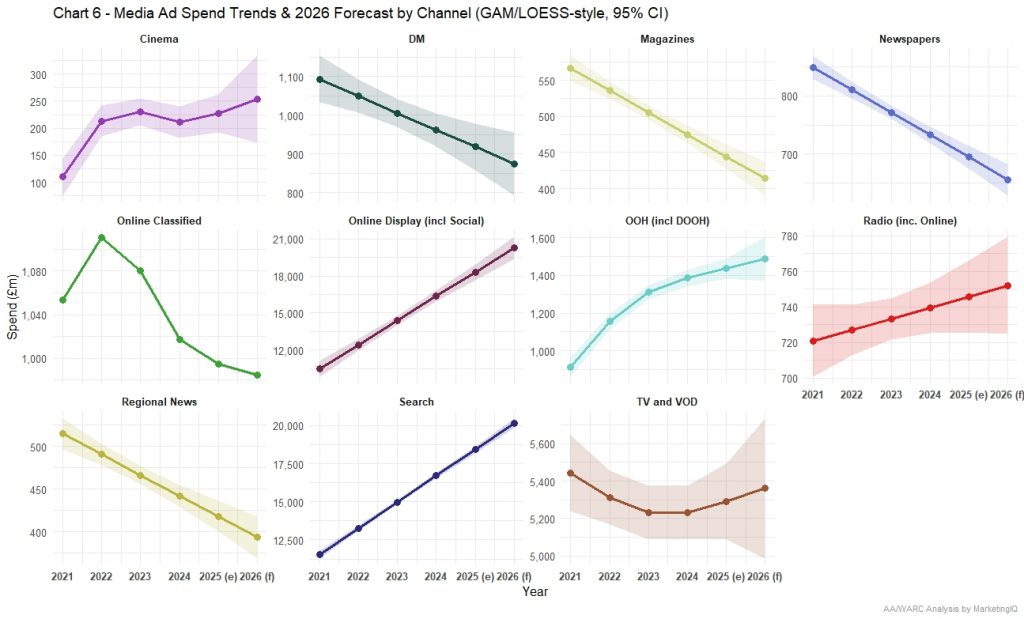

Key UK Adspend forecasts by channel – key take-outs for 2026:

- Cinema will enjoy moderate growth, and we forecast adspend / revenue of £254m in 2026

- DM will continue a significant downward trajectory, and we forecast adspend / revenue of £874m in 2026

- Magazines will continue to decline quite strongly, and we forecast adspend / revenue of £414m in 2026

- Newspapers will also continue to decline strongly, and we forecast adspend / revenue of £656m in 2026

- Online classified has not recovered since 2022 and is likely to continue to decline and we forecast adspend / revenue of £984m in 2026

- Online display including social will continue to grow and on a strong trajectory and we forecast adspend / revenue breaking through £20bn in 2026

- OOH including DOOH will continue to grow but growth rates are reducing slightly year on year, we forecast adspend / revenue of £1.5bn in 2026

- Radio, including online radio will be stable YoY and we forecast adspend / revenue of £752m in 2026

- Regional news will continue a strong decline, and we forecast adspend / revenue of £394m in 2026

- Search will continue strong growth alongside online display and social and we forecast search will also break through the £20bn level in 2026

- TV including BVOD will continue to recover vs 2023, but the overall pattern does suggest continued decline and we forecast adspend / revenue of £5.4bn in 2026

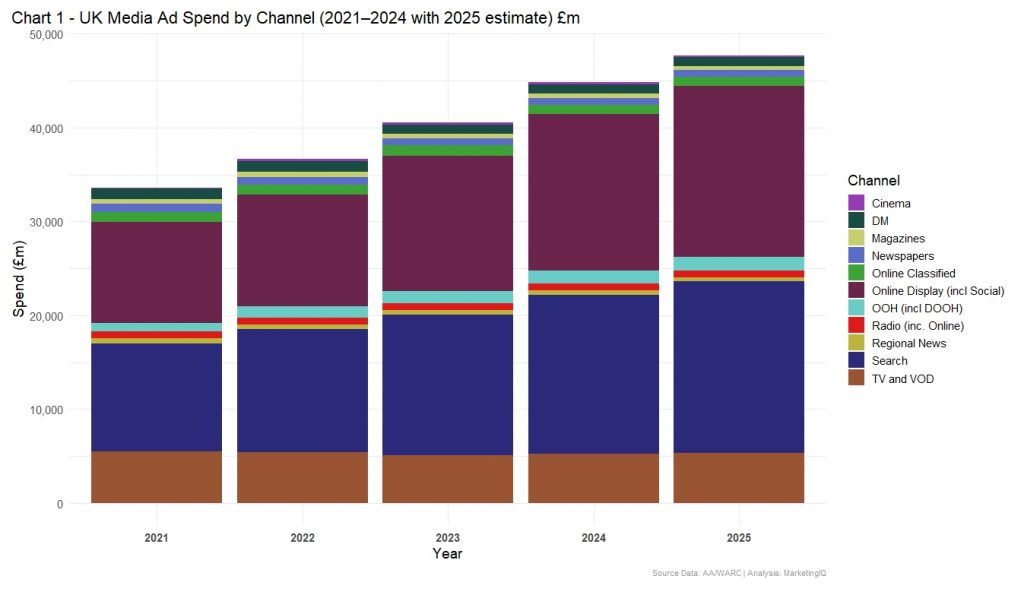

Let’s examine the AA WARC estimates to look at the how media spends have grown across the period 2021 to 2024 as actuals (Chart 1)

We see that total Adspend has grown significantly since 2021. Of course that was a COVID year, but recovery has been strong in terms of total spend.

Totals spend in the channels shown has grown from £33.6bn to £43.8bn. Within this, Search has grown from £11.6bn to £16.9bn and Online Display has grown from £10.8bn to £16.7bn. TV and BVOD has remained relatively flat declining only slightly from £5.5bn to £5.3bn. OOH and DOOH has grown from £901m to £1.4bn. Radio is also flat at £720m to £738m. Cinema, which was hit heavily by COVID restrictions made a strong recovery in both audiences and revenue and climbed from £103m in 2021 to £212m – more than doubling revenue. Fallers include Online Classified £1,053m to £1,017m, Direct Mail falling from £1,082m to £964m, Newspapers £844m down to £727m, and magazines down from £556m to £469m.

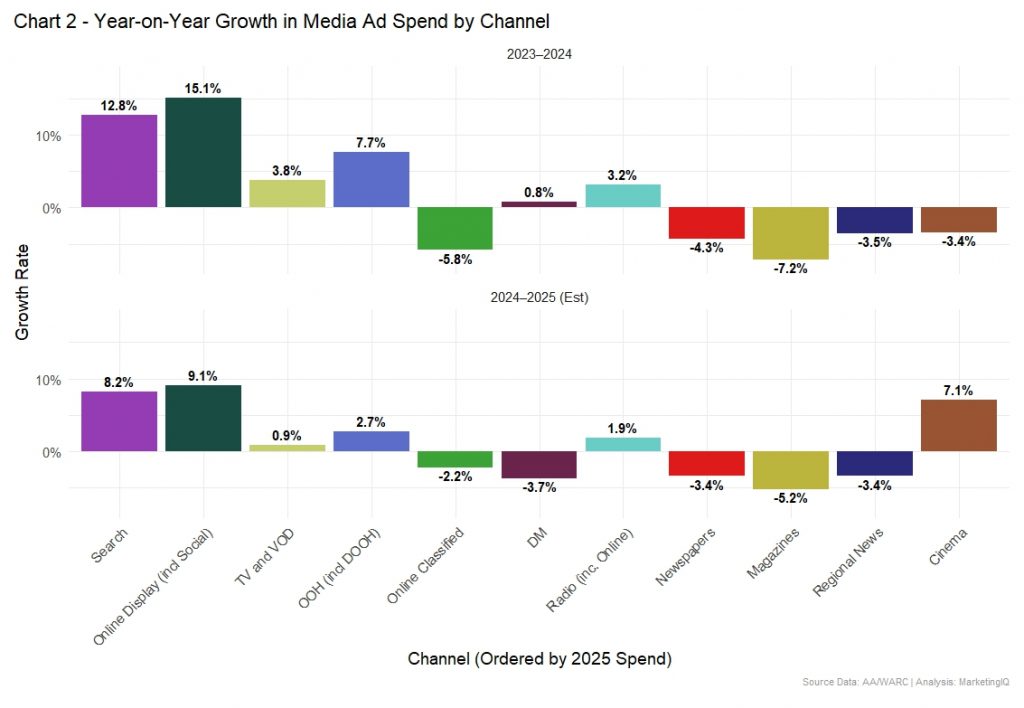

Percentage YoY changes are shown in chart 2 below, with channels ordered by largest spend on the left and smaller on the right (Chart 2)

We see that as well as dominating levels of adspend, Search and Online Display (including Social) dominate growth trends. Between 2023 and 2024, these channels enjoyed YoY growth of 13% and 15% respectively. The 2025 estimates suggest this growth might be calming slightly to 8% and 9% respectively.

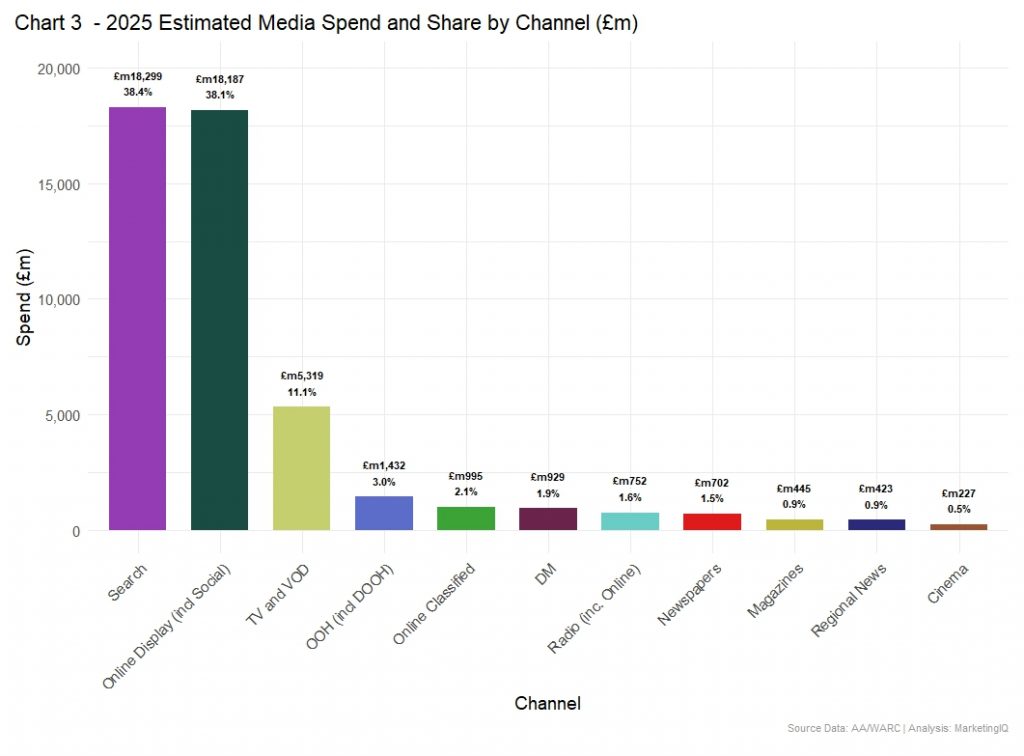

In Chart 3, we see estimated 2025 (full year) media spend across these 11 channels.

We see Search, Online Display and Social are accounting for more than 70% of spend. TV and BVOD sit at 11% and the remaining 8 channels share the balancing 12.4%, with OOH and DOOH the largest of this group at 3%.

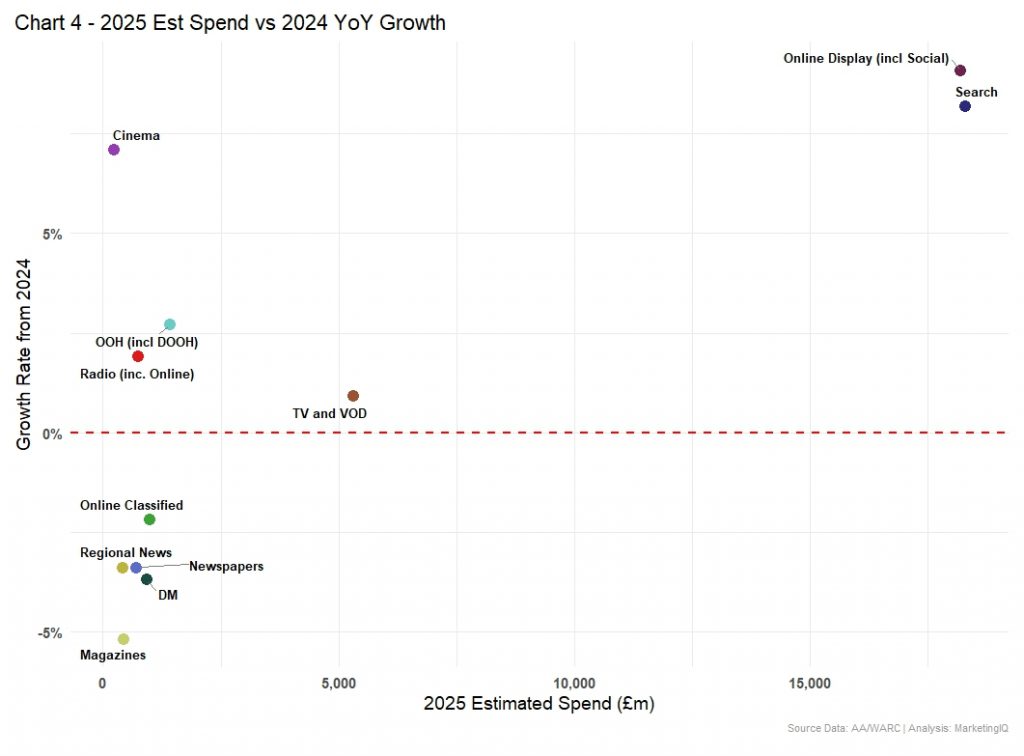

Total spend vs growth in UK media 2025 vs 2024 (Chart 4)

Chart 4 plots 2025 estimates spend and YoY growth from 2024. We see Online Display (including Social) and Search continuing to plough ahead in the top right with high growth and the highest revenues. Unfortunately, in the opposite quadrant, we see a lot of traditional print media in YoY decline; Magazines, Regional Newspaper, Direct Mail and Newspapers.

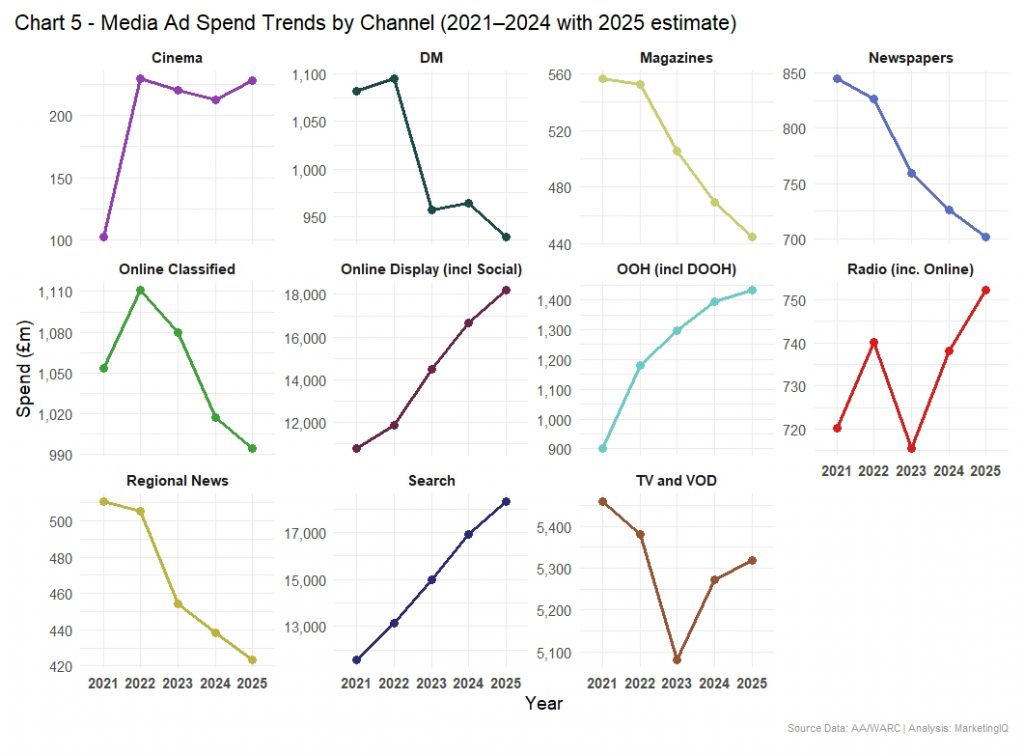

2025 UK Adspend full year estimates (Chart 5)

In Chart 5 below we see growth rate changes between 2021 and the 2025 estimate from AA WARC. We see that Online Search, OOH including DOOH, Online Display (including Social), Radio and TV and VOD are in growth over the period whilst there are five consistent decliners: DM, Magazines, Newspapers and regional news all decline consistently. Online classified has declined consistently since 2022.

UK media adspend forecast for 2026

Chart 6 uses a modelling technique that extrapolates the evolving (non-linear) growth curves into 2026. We see growth in 2026 for Cinema, Online Display and Social, OOH and DOOH, Radio, Search and TV and VOD, although TT/VOD is slightly down from its 2021 position. Downward trends and forecasted to continue for DM, magazines, newspapers and regional news.

Implications for marketing and media planning

The cost of media is generally a reflection of supply and demand – that applies across almost all biddable and non-biddable channels. If audiences (supply) grow, media owner revenues can grow at a flat CPM. This is good news for marketers and their media agency partners (providing demand) because media owners are less likely to raise unit costs (CPMs).

In our analysis of the AA WARC data, we see that some media channels are in high growth; Cinema continues its post-Covid recovery, Online Display (including Social) and Search are powering ahead with growth of more that 8%, slightly down from last year. OOH and DOOH look positive, as does Radio. This growth means that advertisers are likely to see more stable costs in terms of audience CPMs overall (some sub channels and audience sub groups might differ) – simply because media owners can maintain growth within significantly increasing unit costs.

But we also see that some channels are facing revenue declines; Online classified, DM, Newspapers, Magazines and Regional News. Clearly, this is a major concern for both the media owners and advertisers. If the businesses in these channels have high fixed costs, then they have to increase unit costs to increase maintain revenue. This has both short and long term implications; in the short term, media becomes more expensive and potentially performs less well. This in turn makes these channels less likely to be used in the medium term which further exacerbates the revenue decline problem.

Please note this caution: The 2025 and 2026 data are forecasts which identify and extrapolate the underlying growth trends for each channel. They do not account for other important factors such as the economy, the international situation, changes in consumer demand, the health of firms using marketing spends and the budget shifts they may apply in response to changing market scenarios.